Buy Real Estate With Crypto: The Complete Guide for 2026

The real estate market is experiencing a revolutionary shift as cryptocurrency enters the property buying process. Digital assets like Bitcoin and Ethereum are no longer just speculative investments—they’re becoming legitimate tools for purchasing homes, land, and commercial properties. This comprehensive guide will walk you through everything you need to know about how to buy real estate with crypto, from the benefits and challenges to practical steps for completing your purchase.

The Benefits of Buying Real Estate with Cryptocurrency

Using digital assets to purchase property offers several advantages over traditional methods. Understanding these benefits can help you decide if a crypto real estate purchase is right for your investment strategy.

Speed and Efficiency

Traditional real estate transactions typically take 30-45 days to close. When you buy property with cryptocurrency, the settlement can happen in days or even hours. Blockchain technology eliminates many intermediaries, reducing paperwork and accelerating the entire process.

Global Accessibility

Cryptocurrency real estate transactions transcend geographical boundaries. You can buy a house with crypto in another country without establishing a local bank account or navigating complex international banking systems.

Lower Transaction Fees

Real estate paid with bitcoin or other cryptocurrencies often incurs lower transaction fees compared to traditional wire transfers, especially for international purchases. You can avoid expensive currency conversion fees and cross-border charges that typically add 1-3% to transaction costs.

Enhanced Privacy

While not completely anonymous, cryptocurrency transactions offer greater privacy than traditional banking. When you buy real estate with Bitcoin, your personal financial information has less exposure to multiple parties in the transaction chain.

Ready to explore crypto real estate options?

Download our free guide to discover the best platforms and strategies for buying property with cryptocurrency in 2026.

Challenges and Risks of Cryptocurrency Real Estate Transactions

While buying real estate with crypto offers exciting possibilities, it’s important to understand the potential hurdles and risks involved in these transactions.

Potential Challenges

Price volatility can affect transaction value between offer and closing

Limited acceptance among sellers and real estate companies

Regulatory uncertainty in many jurisdictions

Complex tax implications that vary by country

Technical knowledge required for secure transactions

Risk Mitigation Strategies

Use stablecoins like USDT or USDC to reduce volatility risk

Work with specialized crypto real estate platforms

Consult with crypto-savvy real estate attorneys

Maintain detailed transaction records for tax purposes

Consider partial crypto payments combined with traditional financing

Navigate the complexities with expert guidance

Connect with real estate professionals who specialize in cryptocurrency transactions and understand both markets.

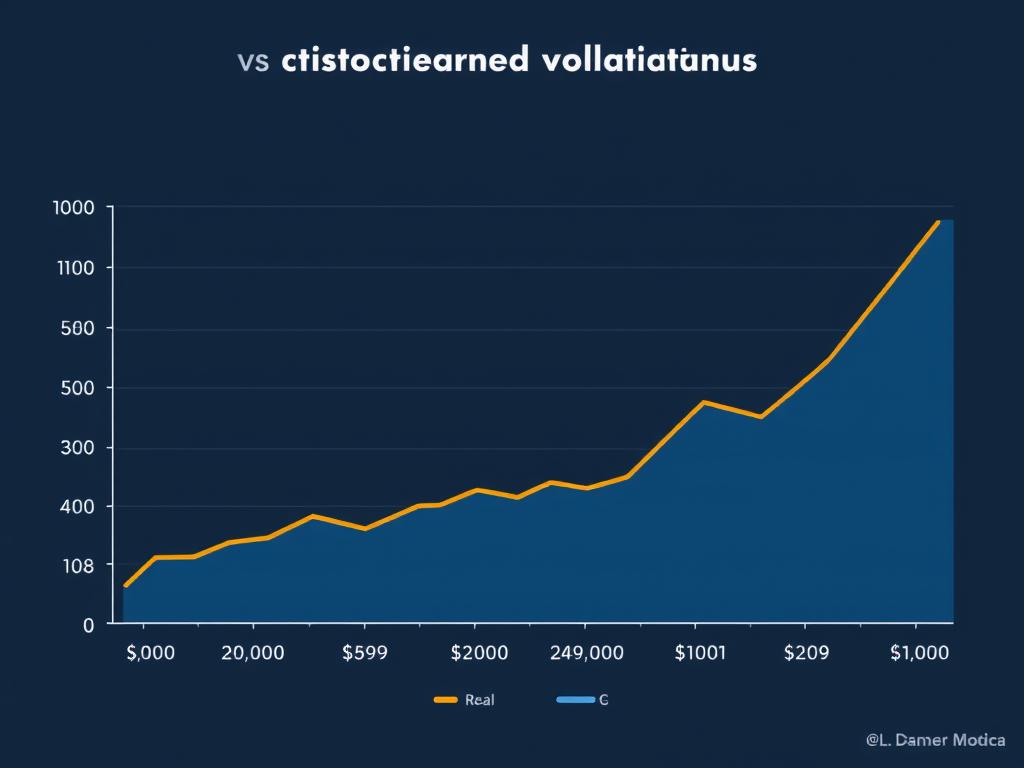

Crypto vs. Traditional Real Estate Purchases: A Comparison

Understanding the key differences between buying property with cryptocurrency versus traditional methods can help you make an informed decision about which approach best suits your needs.

| Feature | Crypto Real Estate Purchase | Traditional Real Estate Purchase |

| Transaction Speed | Hours to days | 30-45 days average |

| Transaction Fees | 0.5-1% typical | 2-5% including banking fees |

| Volatility Risk | High (unless using stablecoins) | Low |

| Regulatory Clarity | Evolving/uncertain in many regions | Well-established |

| Global Accessibility | High – borderless transactions | Limited by banking relationships |

| Privacy Level | Moderate to high | Low – multiple parties involved |

| Seller Acceptance | Limited but growing | Universal |

| Technical Complexity | Moderate to high | Low |

Step-by-Step Guide: How to Buy a House with Crypto

Following these steps will help you navigate the process of purchasing real estate with cryptocurrency, from preparation to closing the deal.

1

Prepare Your Crypto Portfolio

Ensure you have sufficient cryptocurrency holdings for the purchase, including extra to account for potential volatility. Consider converting some assets to stablecoins like USDT or USDC to minimize price fluctuations during the transaction period.

2

Find Crypto-Friendly Properties

Search for listings that explicitly accept cryptocurrency or work with specialized platforms like RealOpen that facilitate crypto real estate transactions. These platforms connect buyers using digital assets with sellers who may prefer traditional payment but are open to crypto buyers.

3

Secure Legal and Tax Guidance

Consult with attorneys and tax professionals who understand both cryptocurrency and real estate. They can help you navigate the complex legal and tax implications of buying property with crypto, which vary significantly by jurisdiction.

4

Obtain Proof of Funds

Generate documentation that verifies your cryptocurrency holdings. Some platforms offer specialized proof of funds letters that translate your crypto assets into traditional currency values that sellers and agents can understand.

5

Make an Offer

Submit your offer, clearly specifying that you intend to pay with cryptocurrency. Include details about which crypto you’ll use and how the transaction will be handled. Be prepared to explain the process to sellers unfamiliar with crypto transactions.

6

Conduct Due Diligence

Perform all standard real estate due diligence, including property inspections, title searches, and reviewing HOA documents if applicable. The crypto aspect doesn’t change the importance of thoroughly vetting the property.

7

Execute the Transaction

Work with a specialized escrow service or platform that can handle cryptocurrency real estate transactions. These services often convert crypto to fiat currency at the time of closing, allowing sellers to receive traditional payment while you pay with digital assets.

Top Platforms for Buying Real Estate with Crypto

Several specialized platforms have emerged to facilitate cryptocurrency real estate transactions. Here’s a look at some of the leading options available to buyers in 2026.

RealOpen

Specializes in high-end properties with direct crypto payment options. Offers proof of funds verification and handles conversion to fiat for sellers who prefer traditional payment.

Supports multiple cryptocurrencies including BTC, ETH, and USDT

No withdrawal limits on transactions

Same-day settlement capabilities

BitPay

Payment processor that works with multiple real estate companies and escrow services to facilitate crypto transactions for property purchases.

Partners with title companies across the US

Supports 12+ cryptocurrencies

Instant conversion to fiat for sellers

Crypto Emporium

Marketplace focused on luxury properties available for purchase with various cryptocurrencies. Offers international listings with full crypto payment options.

Global property portfolio

2.5% sales fee

Support from local property experts

Legal and Tax Considerations for Cryptocurrency Property Transactions

Understanding the legal and tax implications is crucial when engaging in cryptocurrency real estate transactions. These considerations vary significantly by jurisdiction and continue to evolve as regulations develop.

Legal Considerations

Property transfer laws still apply regardless of payment method

Smart contracts may supplement but not replace legal documentation

Title companies may have varying policies on accepting crypto

International purchases may involve additional regulatory hurdles

Tax Implications

Cryptocurrency used for purchases is typically treated as a sold asset

Capital gains tax may apply based on crypto appreciation

Property transfer taxes still apply in most jurisdictions

Record-keeping requirements are often more stringent

Important: Tax regulations for cryptocurrency transactions vary widely by country and continue to evolve. Always consult with a tax professional who specializes in both cryptocurrency and real estate before proceeding with a purchase.

Real-World Examples: Successful Crypto Real Estate Purchases

Examining actual cases of property purchases made with cryptocurrency can provide valuable insights into how these transactions work in practice.

“Transparency was a key factor throughout the entire transaction, which gave me peace of mind. I was particularly impressed with the speed – all payments were made the same day I sent crypto.”

Ilya, Miami property buyer

Luxury Condo in Miami

In 2023, a buyer purchased a $11.4 million condominium in Miami using Bitcoin. The transaction was processed through RealOpen, which converted the 127.2 BTC to USD for the seller. The entire process took just 10 days from offer to closing, compared to the typical 30-45 day timeline for traditional transactions.

International Property Investment

A European investor purchased a $6.7 million apartment in New York using a combination of Bitcoin and Ethereum. By using cryptocurrency, they avoided international wire fees and currency conversion costs that would have added approximately $200,000 to the transaction cost. The cross-border purchase was completed in under two weeks.

The Future of Cryptocurrency in Real Estate

The intersection of blockchain technology and real estate is still in its early stages, but several trends indicate where this relationship is headed.

Increasing Acceptance

More real estate developers and sellers are beginning to accept cryptocurrency as a legitimate payment method. This trend is expected to accelerate as digital assets become more mainstream and stable.

Tokenization of Properties

Fractional ownership through tokenization is emerging as a way to make real estate investment more accessible. This allows investors to purchase portions of properties using cryptocurrency.

Regulatory Development

Governments worldwide are developing clearer regulatory frameworks for cryptocurrency real estate transactions, which will likely provide more certainty and protection for buyers and sellers.

Frequently Asked Questions About Buying Real Estate with Crypto

Which cryptocurrencies can be used to purchase real estate?

While Bitcoin is the most commonly accepted cryptocurrency for real estate transactions, many platforms and sellers also accept Ethereum, USDT, USDC, and other major cryptocurrencies. The specific options depend on the platform or seller you’re working with. Stablecoins like USDT and USDC are becoming increasingly popular due to their price stability.

How do sellers receive payment if they don't want cryptocurrency?

Most crypto real estate platforms offer conversion services that allow buyers to pay in cryptocurrency while sellers receive traditional currency. The platform handles the conversion at the time of closing, often for a small fee. This makes it possible to buy real estate with Bitcoin even when sellers prefer cash.

What happens if cryptocurrency values change dramatically during the transaction?

This is one of the primary risks in cryptocurrency real estate transactions. Some approaches to mitigate this risk include:

Using stablecoins pegged to fiat currency

Including price adjustment clauses in the purchase agreement

Locking in exchange rates through specialized services

Completing transactions quickly to minimize exposure to volatility

Are mortgage lenders accepting cryptocurrency for down payments?

Some forward-thinking lenders are beginning to accept cryptocurrency assets as proof of funds for mortgage qualification, but typically require conversion to fiat currency before the actual down payment. A few specialized lenders are developing programs specifically for crypto investors, allowing them to leverage their digital assets without selling them.

Conclusion: Is Buying Real Estate with Crypto Right for You?

Purchasing property with cryptocurrency represents an innovative intersection of digital finance and traditional real estate. While it offers significant advantages in terms of speed, cost, and global accessibility, it also comes with unique challenges related to volatility, regulation, and technical complexity.

For crypto investors looking to diversify into tangible assets without converting to fiat currency, buying real estate with Bitcoin or other cryptocurrencies can be an attractive option. The growing ecosystem of specialized platforms and services is making these transactions increasingly accessible, even to those without extensive technical knowledge.

As with any significant investment decision, thorough research and professional guidance are essential. By understanding both the opportunities and risks involved in cryptocurrency real estate transactions, you can determine whether this innovative approach aligns with your investment goals and risk tolerance.

Ready to explore your crypto real estate options?

Our experts can help you navigate the process of buying property with cryptocurrency, from finding the right platform to closing the deal.